So long, fees.

Hello, Paisaa.

We are on a mission to make life more affordable for India using technology-led solutions.

Making life affordable

Paisaaloan is the largest and fastest growing consumer lending fintech company in India founded by Mousam Kumar in 2024.

What We Offer?

Our Story

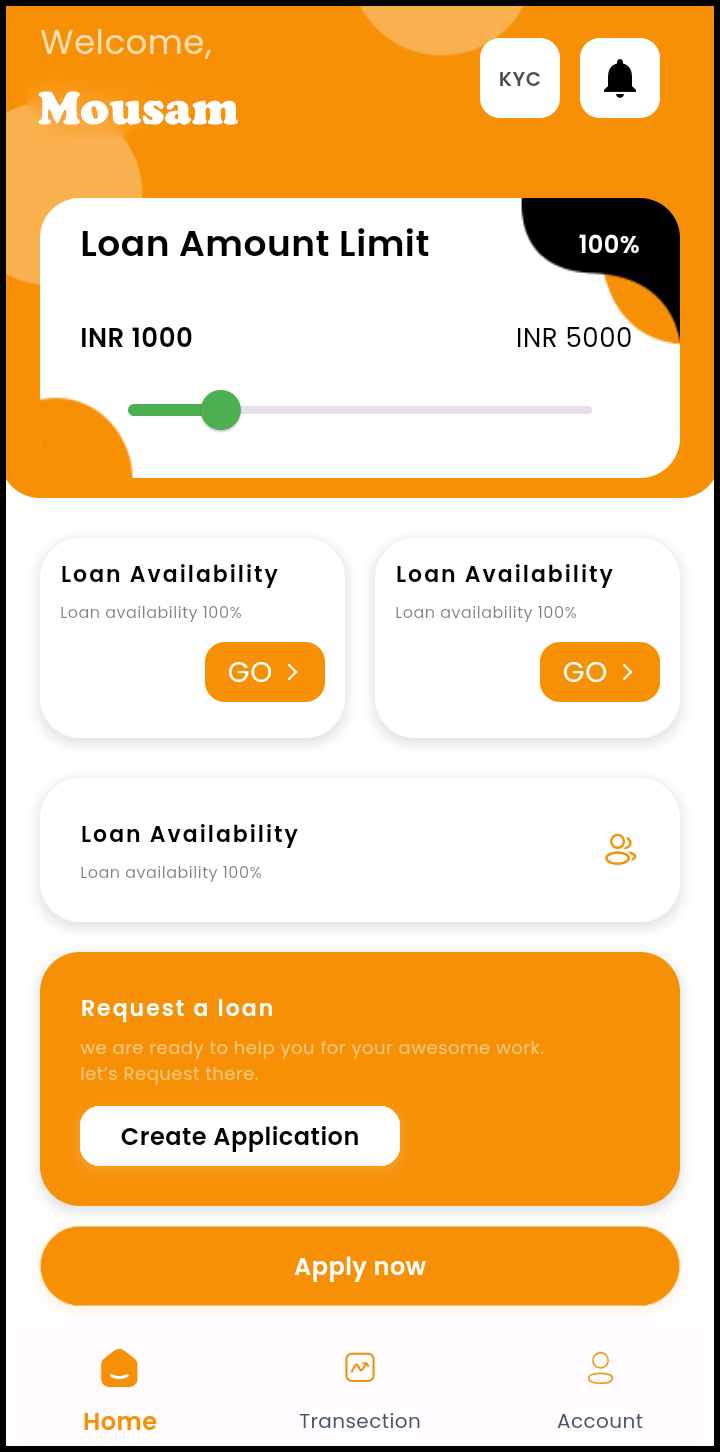

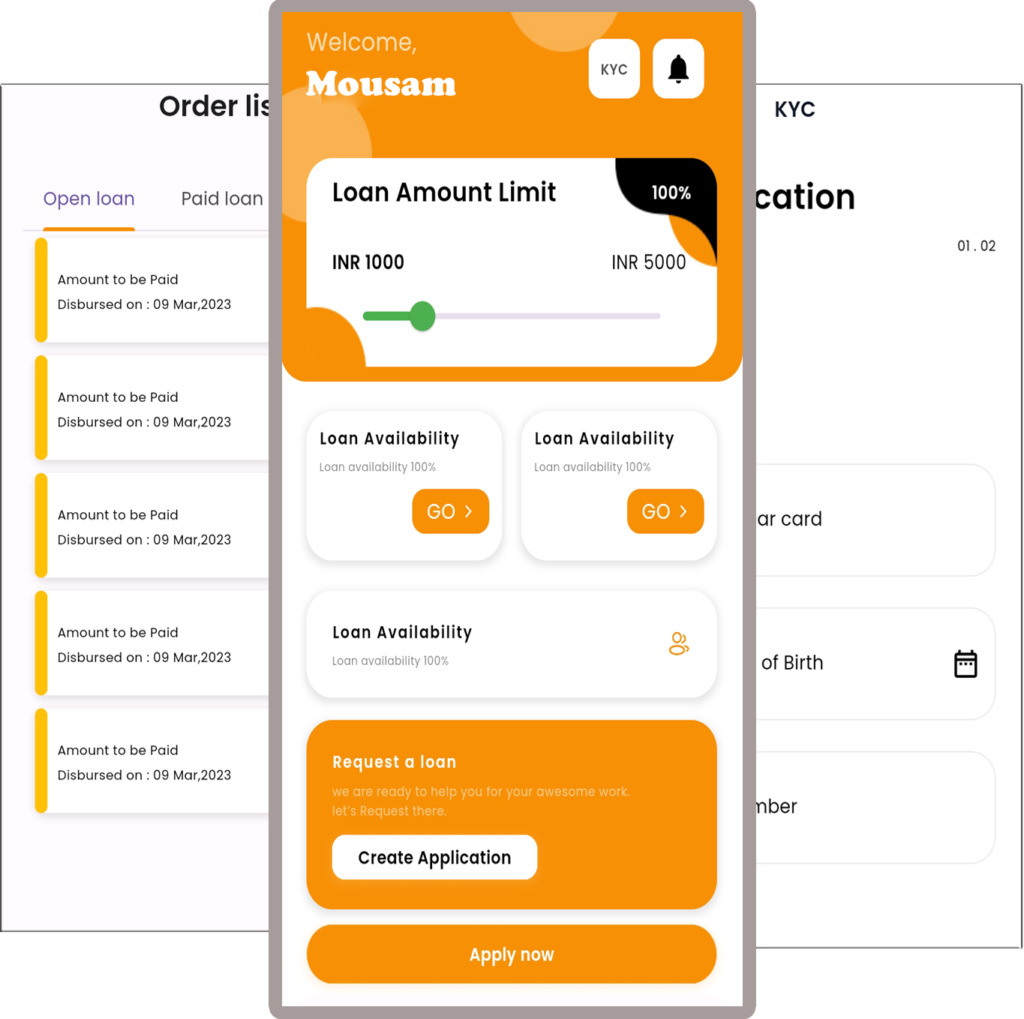

PaisaaLoan is a leading financial services provider committed to revolutionizing the lending industry through innovation, transparency, and customer-centric solutions. Founded by a team of seasoned financial experts and technology enthusiasts, our mission is to make borrowing simple, accessible, and stress-free for everyone. We understand that each individual and business has unique financial needs, and we are dedicated to offering tailored loan products that empower our customers to achieve their goals. With a strong foundation built on trust and integrity, PaisaaLoan stands out as a reliable partner in your financial journey. PaisaaLoan application provide you 100% online platform to give you loan in a few minutes after completing all criteria and fullfill details it provides loan up to 15,000 rupees. In your all needs whether you have to pay off debt, pay fees, or any educational needs you can approve your loan from www.paisaaloan.com . We are aiming to provide innovative and flexible loan solutions that cater to the diverse needs of our customers. We envision a world where financial services are straightforward, transparent, and accessible to all. At PaisaaLoan, we believe that financial empowerment is a fundamental right, and our goal is to bridge the gap between borrowers and the financial resources they need. By leveraging technology and maintaining a customer-first approach, we aim to transform the way people perceive and experience financial services, fostering a culture of trust and reliability.

The Birth of PaisaaLoan:

The inception of PaisaaLoan traces back to a simple yet profound vision: to create a financial service that truly understands and meets the diverse needs of its customers. PaisaaLoan was founded by a group of financial experts and tech enthusiasts who shared a common goal: to revolutionize the lending industry by making it more transparent, accessible, and customer-centric. Our founders recognized that the traditional lending processes were often cumbersome and intimidating, creating barriers for individuals and businesses seeking financial assistance. With this in mind, they embarked on a mission to develop a platform that simplifies borrowing and puts the customer first.

Our Vision:

From the outset, our vision has been to empower individuals and businesses by providing innovative loan solutions that are easy to access and tailored to their specific needs. We believe that financial services should not be complicated or intimidating. Instead, they should be straight forward, supportive, and designed with the customer in mind. Our goal has always been to bridge the gap between borrowers and the financial resources they need, fostering financial inclusion and stability. We envisioned a world where obtaining a loan is a smooth and positive experience, enabling people to achieve their dreams and

aspirations.

The Early Days:

In our early days, we set out to identify the common pain points that borrowers face. We conducted extensive research, speaking with hundreds of individuals to understand their challenges and frustrations with traditional lending processes. These insights fueled our determination to create a platform that simplifies borrowing and offers a seamless experience from start to finish. We realized that to truly make a difference, we needed to address the inefficiencies and lack of transparency that plagued the industry. Our team worked tirelessly to develop an intuitive online application platform, leveraging cutting-edge technology to streamline the process and reduce unnecessary delays.

Building a User-Friendly Platform:

One of our first major milestones was the development of our user-friendly online application platform. We recognized that the key to a successful lending experience lies in its accessibility and ease of use. Our platform was designed to eliminate the need for cumbersome paperwork and lengthy approval times. With a few simple steps, customers can apply for loans from the comfort of their homes and receive quick decisions. This innovation not only enhanced the customer experience but also set a new standard for the industry. Our commitment to leveraging technology for customer benefit has been a driving force behind our continued growth and success.

Growing and Evolving:

As we grew, so did our understanding of our customers’ needs. We expanded our product offerings to include a variety of loan types, such as personal loans, business loans, and home loans. Each product was crafted with flexible terms and competitive rates to ensure. we could support our customers through various stages of their financial journeys. Our ability to adapt and evolve based on customer feedback has been integral to our success. We continuously seek to refine our offerings and processes to better serve our customers, ensuring that we remain at the forefront of the lending industry.

Commitment to Transparency and Trust:

At PaisaaLoan, transparency is a core value. We believe that trust is earned through honesty and integrity. From our inception, we committed to providing clear and detailed information about our loan products, ensuring there are no hidden fees or surprises. Our transparent practices have built a strong foundation of trust with our customers. We understand that financial decisions can be daunting, and our goal is to make them as straightforward and stress-free as possible. By maintaining open communication and setting clear expectations, we have established ourselves as a reliable and trustworthy financial partner.

Focus on Customer Service:

Our dedication to exceptional customer service has always been a driving force. We assembled a team of passionate professionals who are not only experts in their fields but also genuinely care about helping our customers succeed. Whether it’s guiding someone through the loan application process or offering financial advice, our team is always ready to support and assist. We believe that the human touch is irreplaceable, and our commitment to providing personalized service has earned us a loyal customer base. Our customer-centric approach ensures that every borrower feels valued and understood.

Community Engagement:

We also recognize the importance of giving back to the communities we serve. Over the years, we have engaged in various community initiatives, from financial literacy programs to local volunteer efforts. We believe in making a positive impact beyond just providing financial services. Our team members actively participate in community outreach activities, using their skills and resources to support those in need. This commitment to social responsibility reflects our belief that a successful business should also contribute to the well-being of society. By fostering financial literacy and supporting community

development, we aim to create a lasting positive impact.

Looking Ahead:

As we look to the future, our commitment to innovation, transparency, and customer-centric service remains unwavering. We continue to explore new ways to enhance our offerings and improve our customers’ experiences. Our story is one of growth, learning, and a steadfast dedication to making financial empowerment accessible to all. We are excited about the opportunities that lie ahead and are determined to remain at the forefront of the lending industry. By continuously evolving and staying true to our core values, we aim to help more individuals and businesses achieve their financial goals.

Paisaaloan

Stay On Top Of Your Portfolio

Loans Anytime. Loans From Anywhere.

Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors

Download the app now to start trading today!